|

|

|

|

|

IMPACT OF DIGITAL KYC AND ONLINE ACCOUNT OPENING ON CUSTOMER EXPERIENCE IN STOCK BROKING FIRMS

Riya Pareek 1![]()

![]() ,

Dr. Vishal Dilip Chavan 2

,

Dr. Vishal Dilip Chavan 2![]() , Dr. Bhawna Sharma3

, Dr. Bhawna Sharma3![]()

1 BBA

Student, Amity Business School, Amity University Mumbai,

Mumbai, Maharashtra, India

2 Associate

Professor, Amity Business School, Amity University

Mumbai, Mumbai, Maharashtra, India

|

|

ABSTRACT |

||

|

Customers' interactions with stock broking companies have changed as a result of the financial services industry's fast digitization, especially with the arrival of online account opening platforms and digital Know Your Customer (KYC) processes. By doing away with paperwork, cutting down on verification time, and allowing account activation in a matter of minutes, these advancements have made the initial setup procedure simpler. With a focus on convenience, effectiveness, security, and satisfaction, this study investigates how digital KYC and online account creation affect the client experience in the Indian stock brokerage industry. People who have used digital onboarding services provided by popular stock brokerage companies, were given a structured questionnaire via Google Forms, which was used to gather primary data for the study. Descriptive methods of statistical analysis were used to analyse the responses in order to find customer opinions and trends. The results show that by simplifying the account creation and verification procedures, digital KYC and online account opening have significantly boosted client ease, accessibility, and overall satisfaction. The report does, however, pay attention to persisting worries about data privacy, technological issues, and the lack of personalized support for new users. Based on the

study's overall findings, online account opening and digital KYC have

improved and modernized the client experience by speeding up and simplifying

stock market participation. However, companies must continue enhancing user

interface design, customer support, and cybersecurity safeguards to provide

an uninterrupted and reliable digital onboarding experience. |

|||

|

Received 28 April 2025 Accepted 29 May 2025 Published 30 June 2025 Corresponding Author Riya

Pareek, riyapareek0108@gmail.com DOI 10.29121/ShodhAI.v2.i1.2025.53 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Digital KYC, Online Account, Customer, Stock Broking |

|||

1. INTRODUCTION

Financial technology (FinTech) advancements, changes in regulations, and consumers' increasing need for convenience have all contributed to the financial services sector's recent remarkable digital transition. The use of online account opening platforms and digital Know Your Customer (KYC) processes, especially in stock broking businesses, is one of the most important advancements in this development. These procedures are replacing traditional, paper-based onboarding methods with automated digital solutions that allow clients to open trading accounts, finish regulatory requirements, and verify themselves in just a few minutes.

Digital KYC and online account opening have transformed the consumer experience while also increasing efficiency in operation for stock broking companies. Consumers increasingly expect flawless user interfaces, rapid service delivery, and safe digital platforms which enable easy investment decisions. Understanding how these modern onboarding methods affect client satisfaction has become more essential as public involvement in India's capital markets grows quickly, particularly via mobile-based trading platforms.

Digital processes have shortened delivery times and improved accessibility, but they have also raised worries about cyber security, data privacy, and the mechanical character of digital interactions. As a result, identifying how to balance efficiency and trust becomes essential when reviewing the entire client experience.

The purpose of this study is to look into how online account creation and digital KYC affect the client experience in the Indian stock broking industry. In order to improve trust and participation, it aims to assess observed convenience and safety, identify important factors that influence client satisfaction, and study areas where digital solutions can be improved further.

2. Review of literature

The means by which clients interact with stock broking firms has been completely transformed by the digitalization of financial services. Faster, more accessible, and more efficient digital alternatives have taken over old paper-based processes with the rise of digital KYC and online account opening systems.

According to Gupta and Arora (2020), financial organizations that undergo digital transformation increase productivity and boost customer satisfaction by automating processes. In the same way, Kumar (2021) highlighted how FinTech technologies have raised consumer expectations for convenience and speed.

Digital KYC improves accuracy and accessibility while reducing enrolment time and errors, according to studies like Kaur and Mehta (2020). Concerns about data security and privacy, however, still affect confidence among customers. According to Rao and Singh (2022), creating an account online significantly improves accessibility and convenience, but it can also be delayed by technical difficulties or a lack of customer service.

Davis (1989) suggested that the acceptance of digital systems is influenced by the perceived value and ease of use, based on the Technology Acceptance Model (TAM). This concept was later applied to financial technology by Bhatia and Jain (2021), who highlighted that data safety and reliability are crucial for satisfying client experiences.

even though a lot of research examines digital KYC in banking, not much of it focuses on stock brokerage companies particularly. The purpose of this study is to close that gap through analysing the ways in which digital onboarding procedures affect consumer satisfaction, convenience, and trust.

3. RESEARCH METHODOLOGY

1) Research

Design

Sampling Size and Method

· Target Audience: Individuals familiar with or interested in stock trading, including both users and non-users of digital account opening systems.

· Sampling Method: Random sampling was employed to ensure diverse representation across professions and age groups.

· Sample Size: A total of 93 respondents participated in the survey.

2) Method

of data collection

Survey Method: An online Google Forms questionnaire was used to gather primary data. Responses from both people who have opened a digital account and those who have not were intended to be included in the form. This method offered a fair assessment of non-users' awareness and perceptions in addition to the user experience.

Structure of the Questionnaire:

The questionnaire consisted of multiple sections:

· Section A: Demographic Information: Age group, gender, and occupation.

· Section B: For Respondents Who Have Not Opened an Account Online: Questions on awareness, reasons for not opting for digital KYC, and perceived barriers.

· Section C: For Respondents Who Have Opened an Account Online: Questions on ease of use, security, satisfaction, and comparison with traditional onboarding.

· General Perception Items: Views on digital transformation and willingness to adopt online processes in the future.

3) Limitations

of the Study

· Self-Reporting Bias: Responses are based on participants’ perceptions, which may not fully reflect actual behaviour.

· Scope of Data: The study is limited to survey responses and does not include in-depth interviews or data from specific firms.

· Generalizability: Findings may not represent the views of the entire investor population due to sample size constraints.

4. DATA ANALYSIS AND FINDINGS

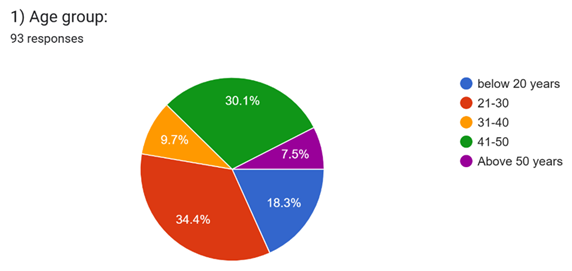

The majority of responders (34%) are between the ages of 21 and 30, with 30% being over 50. This indicates that both younger and older investors who are familiar with stockbroking platforms are participating.

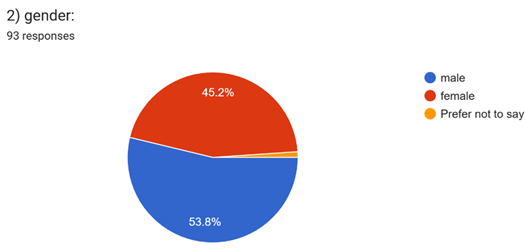

Gender diversity in the adoption of digital finance is increasing, as seen by the almost balanced response of 54% male and 45% female participants.

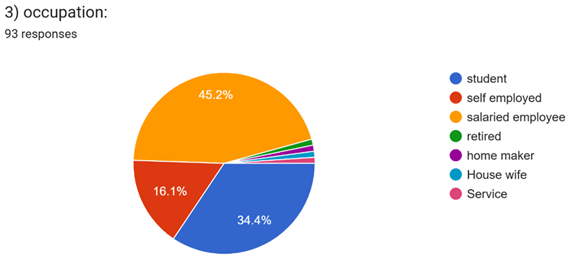

Students (34%) and retirees (45%) made up the majority, indicating a mix of early-stage investors and experts with different levels of digital experience.

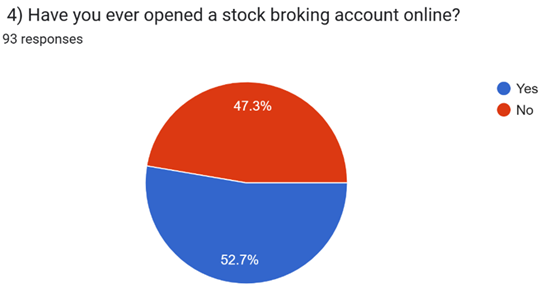

While 43% of respondents have not yet used digital onboarding for a variety of reasons, approximately 57% of respondents have opened an account online, indicating an increasing use of the process.

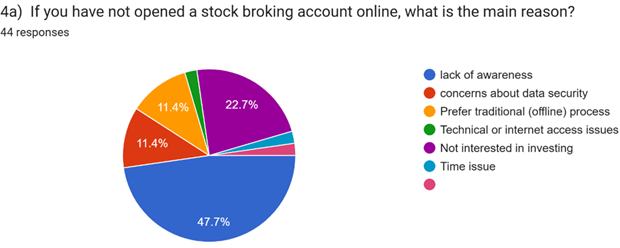

48% of non-users said they were unaware, 22% said they were worried about data security, and 14% said they had technical or internet problems. This suggests that reluctance is more likely to result from a lack of trust and knowledge than from a preference for conventional approaches.

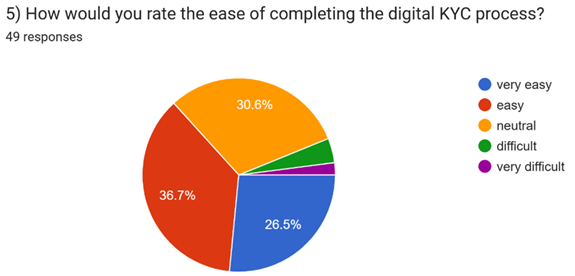

The digital KYC procedure was regarded as easy or very easy by over 70% of users, indicating that most platforms are easy to use and intuitive.

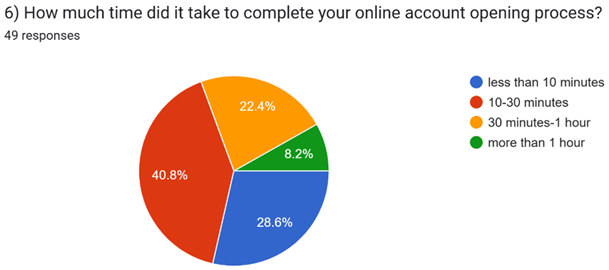

Most finished the process in 10 to 30 minutes, indicating significant operating efficiency as compared to traditional methods.

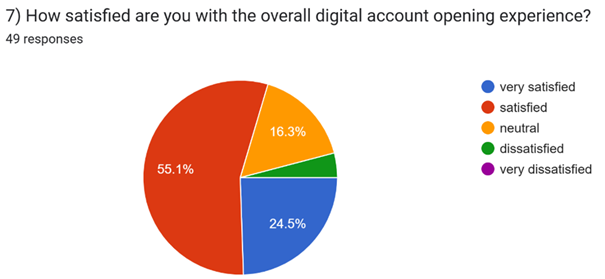

Digital onboarding was rated satisfactory or very satisfactory by almost 75% of respondents, indicating a generally favourable client experience.

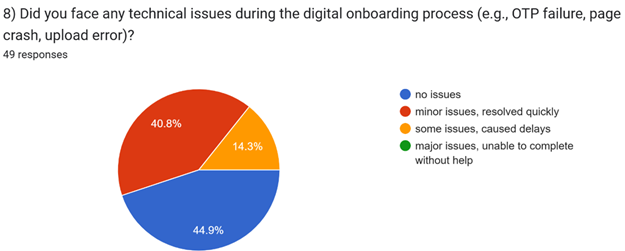

About 40% of respondents experienced small problems like upload mistakes or OTP delays, while 43% reported no issues at all, indicating generally efficient but sometimes irregular performance.

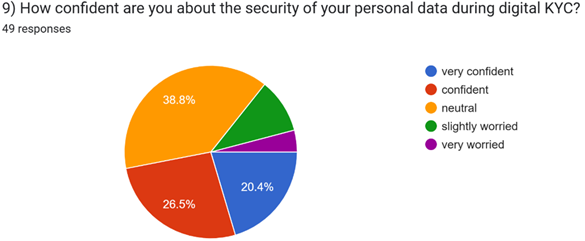

Despite the fact that 47% of respondents were confident about the security of their personal data, 39% were neutral and 14% stated concern, indicating the continued lack of clarity surrounding data protection.

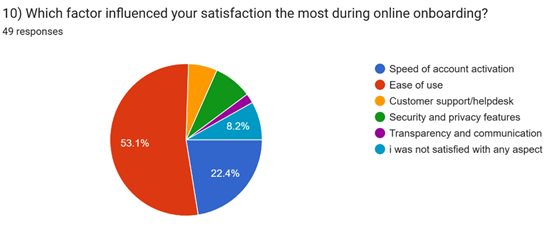

Convenience and efficiency are important drivers of pleasant experiences, as evidenced by the fact that ease of use (53%) and speed of activation (22%) were the most significant elements influencing satisfaction.

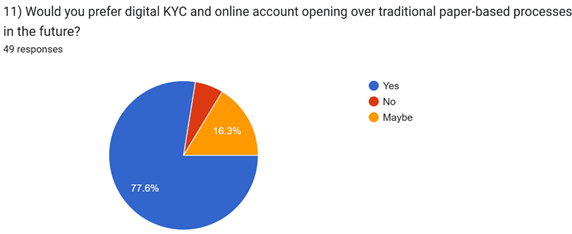

A vast majority (71%) favour digital KYC and account opening over conventional techniques, demonstrating the increasing acceptance and confidence in online procedures.

5. RECOMMENDATIONS

Stock brokerage companies should use methods that include customer-centric design, strong data governance, and technical progress to enhance the effectiveness of digital KYC and online account opening.

1) Increase

Awareness and Investor Education

Stock brokerage companies should run awareness efforts and investor education initiatives since ignorance was the main barrier to utilizing digital onboarding. First-time users' reluctance can be decreased by using social media, brief explanation films, and in-app tutorials to explain how digital KYC and account opening operate.

2) Strengthen

Platform Reliability and Technical Support

Businesses should concentrate on enhancing backend systems and server capacity since almost 40% of users experienced minor technical concerns like OTP or upload failures. Process drop-offs can be reduced and the onboarding experience improved by offering timely technical help and in-app bug fixing.

3) Reinforce

Data Security and Build Transparency

Businesses need to actively promote their security procedures because over half of respondents are either uncertain or confused about the protection of their data. Consumer trust can be increased by multi-factor authentication, visible privacy disclaimers, and regular security inspections.

4) Standardize

User Experience Across Platforms

The varied satisfaction levels point to inconsistent onboarding quality. Brokering companies should make sure that all platforms—web, app, and partner integrations—have consistent performance criteria. UI/UX testing and regular client input can improve satisfaction and quicken procedures.

5) Promote

Digital Inclusion and Accessibility

Businesses should streamline onboarding interfaces and incorporate user-friendly visual aids because a large number of respondents were either retired or students. The digital literacy gap can be closed by offering multilingual options and optional aided onboarding via helplines or video verification.

6. CONCLUSION

The study examined the influence of digital KYC and online account opening on customer experience in stock broking firms. The findings suggest that digital onboarding has greatly improved investor accessibility, efficiency, and convenience. In line with India's transition to paperless and technologically advanced financial systems, the majority of respondents who utilized digital KYC reported pleasure, especially complimenting its speed and simplicity.

Even with these benefits, there are still some difficulties. Even though the majority of technological problems were small, they happened often enough to cause some consumers to experience disruptions. Digital adoption is still not widespread, as evidenced by the fact that many respondents expressed worry about data security and privacy and that non-users mentioned ignorance as their primary obstacle.

The study's overall findings indicate that while digital KYC and online account creation have enhanced customer satisfaction, ongoing attention to trust, awareness, and user support is still necessary. Stock broking companies may make digital onboarding more dependable, inclusive, and effective by investing in safe, user-friendly technologies and boosting customer education.

CONFLICT OF INTERESTS

None .

ACKNOWLEDGMENTS

None.

REFERENCES

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of use, and User Acceptance of Information Technology. MIS Quarterly, 13(3), 319–340. https://doi.org/10.2307/249008

Kaur, H., and Mehta, S. (2020). The Role of e-KYC in Improving Customer Onboarding Efficiency in

Indian Banking. Asian Journal of Business and Economics, 8(1), 56–64.

Rao, D., and Singh, P. (2022). Impact of Online Account Opening Systems on Investor Satisfaction in Stock Broking Firms. Indian Journal of Finance and Technology, 17(2), 72–83.

Securities and Exchange Board of India. (2023, October 12). Master Circular on Know Your Client (KYC) Norms for the Securities Market [Master circular].

ANNEXURE

Section A: Demographic Information

(Please tick or fill in the appropriate option)

1) Age

Group:

☐ Below 20 years

☐ 21–30 years

☐ 31–40 years

☐ 41–50 years

☐ Above 50 years

2) Gender:

☐ Male

☐ Female

☐ Prefer not to say

3) Occupation:

☐ Very Satisfied

☐ Satisfied

☐ Neutral

☐ Dissatisfied

☐ Very Dissatisfied

4) Did

you face any technical issues during the digital onboarding process (e.g., OTP

failure, page crash, upload error)?

☐ No issues

☐ Minor issues, resolved quickly

☐ Some issues, caused delays

☐ Major issues, unable to complete without help

5) How

confident are you about the security of your personal data during digital KYC?

☐ Very Confident

☐ Somewhat Confident

☐ Neutral

☐ Slightly Worried

☐ Very Worried

6) Which

factor most influenced your experience (positive or negative) during online

onboarding?

☐ Speed of account activation

☐ Ease of use/interface

☐ Customer support/helpdesk

☐ Security and privacy features

☐ Transparency and communication

☐ I was not satisfied with any aspect

7) Would

you prefer digital KYC and online account opening over traditional paper-based

processes in the future?

☐ Yes

☐ No

☐ Maybe

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© ShodhAI 2025. All Rights Reserved.